For 'reasons', my council tax account became a little bit complicated. Part of the reason it became complicated was we had to evacuate our house after a fire, the other part of the reason it became complicated has been since our house is currently uninhabitable we're obviously not living there, we're living somewhere else - and thus we're rocking two separate council tax bills during this billing year.

Now whilst proportionately very few people evacuate their homes after a fire (though in a large city or borough the absolute number isn't going to be small - the fire service after all receive shouts on a daily basis), lots of people move house every day of the year, not just on 1 April when the billing day is. Of those lots of people, lots of them will be moving to a house in a different council tax band from where they previously lived, and lots of those people will be paying their council tax by 10 monthly payments, meaning what might be owing isn't going to be a simple case of 'the number of monthly payments remaining in the year multiplied by the amount of the monthly payment'.

When you tell the council you're moving house, fortunately they'll work out what you owe on your previous home and what you'll be owing for your new home. If your monthly direct debit payments are not changing, all that's happening is the payment account number is changing, but you're still going to want to check in your online council tax account that everything's kushty, right?

In my case, whilst it's currently not clear who is ultimately going to be paying how much council tax whilst our home is uninhabitable, I still had a bill to pay with threats of legal action if I didn't. Since I was in the fortunate position that our contents insurance settlement had given us a reasonable lump sum as an interim payment, it was easy enough for me to clear the balance on our home and pay the balance on the flat we've moved into, and I’ll sort out what I'm actually owed by third parties later. And as a result of just paying those two lump sums it resulted in me overpaying by £171.57, an amount which should be credited to my account against next year's bill.

So I went to check my online account to establish everything was indeed up to date, and in the words of a subeditor of a clickbait ad farm site, what I saw next terrified me...

The online portal the council I pay my council tax to is a common portal provided by a large multiglobal megacorp - it's ubiquitous across a large number of councils, therefore I will surely not be the only person in the UK who has gone to look at their council tax account balance and been left fearing a very hard knock at the door any day now.

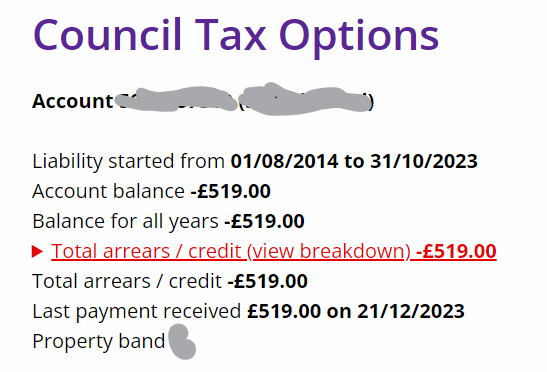

Looking at the account summary statement for our currently uninhabitable house:

Hang on, what's with the red line saying total arrears -£519‽ A negative number, marked in red, and the word 'arrears' means I owe money, doesn't it? That's worrying!

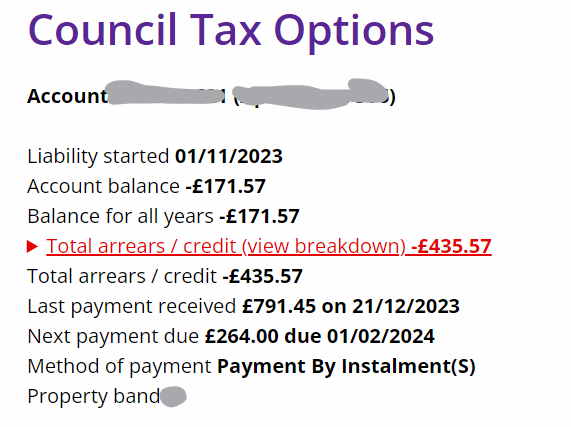

Now looking at the account information for the flat I'm living in:

There's no getting around this, I'm totally confused; not just because of the confusing way being in arrears vs owing on a monthly payment plan vs being in credit is actually shown, but also because whilst I can see that £171.57 on the screen there (showing as a negative number, which I'd interpret as meaning it's money I owe), I can't see how it shows up as being money the council owes me, or how it's going to be applied as an offset to next year's bill.

But wait, what? Why does it think I'm due to make a payment of £264 on 2 February? The council owes me money, after all, not the other way round! I'm going to have to contact them, aren't I...

Whilst there are almost certainly legal reasons for some of the words used, it would be interesting to know if the whole presentation of the account summary is legally stipulated to be precisely and invariantly how it's presented on this common ubiquitous portal. If it is legally stipulated that the formal communication of the account summary must be exactly like this, is it legally stipulated that no human-readable version may exist alongside it?

Take specifically the word 'arrears' as used here. Arrears means 'money you owe', and yes indeed if you've got a council tax bill for £1,000 that you're paying in 10 monthly instalments, so by the middle of August you've paid £500 meaning you're still £500 in arrears. But - and I appreciate it would take user research to either validate or invalidate my hypothesis here - in this context, I don't think most people on the Southport Omnibus would take 'arrears' as meaning that strict meaning. I think most people paying their council tax monthly on time would, as far as they're concerned, see themselves as being up to date with their payments - I think most people would know they still owe £500 on the total annual bill, but because they're up to date on their payments they would not see themselves as being in arrears, they would only see themselves as being in arrears if they've missed one or more payments on their monthly payment plan.

And I think the mental gymnastics of working out the chain of conflicting negatives of a minus number coupled with the twin words arrears and credit coupled with the meaning of the negative number on one line having the opposite - from the user perspective - meaning from on the other line coupled with the standard colour coding of red meaning 'this is bad, you owe money' will make for not just me with a Masters degree and a reasonably good understanding of how council tax works be confused, I think most people relying on this common portal will be confused. It would be interesting to know how many council tax enquiries there are nationally from people who have access to their online council tax portal trying to find out what their balance is because they can make neither head nor tail of the on-screen balance.

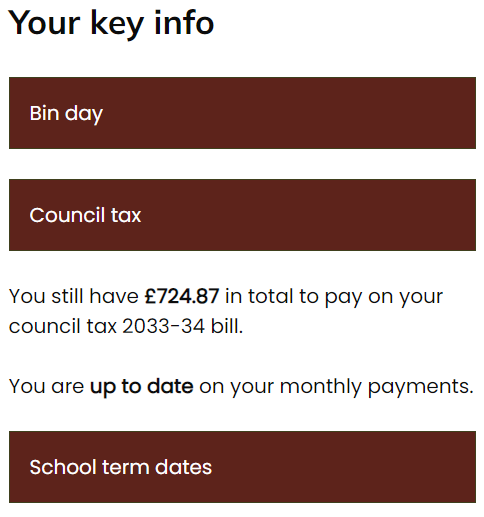

I think this should be much clearer to the user:

On the BigTown Council home page, in the personalisation area, I suggest a concise, explicit, and unambiguous statement of the user's council tax balance summary; how much do you still have to pay on your bill for this year, and whether or not you're up to date with your payments.

The questions remaining, then, are [a] is it within the law to make it this simple to the citizen, and [b] can council tax online portals be configured to make it appear this simple? And if the answer to either of those questions is 'no', what can we do to change both answers to be 'yes'?